Tip Reporting Form - Annually report to the irs receipts and tips from their large food or beverage establishments. You can use form 4070a, employee's daily record of tips,. Provide it in any format, but put it in writing: You may use irs form 4070 to report tips to your employer. Report all tips on an individual income tax return. Keep a daily tip record. This includes both server cash tips as well as credit card tips recorded by your pos system for each server. Determine allocated tips for tipped employees. Employees must keep a daily record of tips received. Employers use form 8027 to:

Provide it in any format, but put it in writing: You can use form 4070a, employee's daily record of tips,. Generally, you must report all tips you received in the tax year on your tax return. Otherwise, here is the information required; Keep a daily tip record. This includes both server cash tips as well as credit card tips recorded by your pos system for each server. Employers use form 8027 to: Annually report to the irs receipts and tips from their large food or beverage establishments. You may use irs form 4070 to report tips to your employer. Determine allocated tips for tipped employees.

You may use irs form 4070 to report tips to your employer. Determine allocated tips for tipped employees. Otherwise, here is the information required; Provide it in any format, but put it in writing: You can use form 4070a, employee's daily record of tips,. Employees must keep a daily record of tips received. Annually report to the irs receipts and tips from their large food or beverage establishments. Keep a daily tip record. This includes both server cash tips as well as credit card tips recorded by your pos system for each server. Employers use form 8027 to:

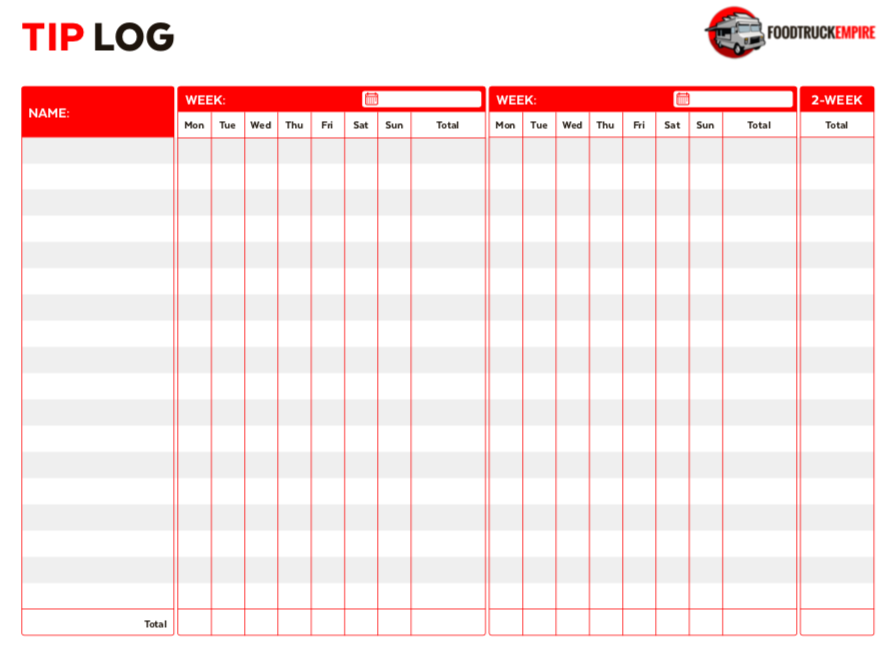

Download Templates Printable Restaurant Tip Reporting Forms

This includes both server cash tips as well as credit card tips recorded by your pos system for each server. Employees must keep a daily record of tips received. Determine allocated tips for tipped employees. Provide it in any format, but put it in writing: Employers use form 8027 to:

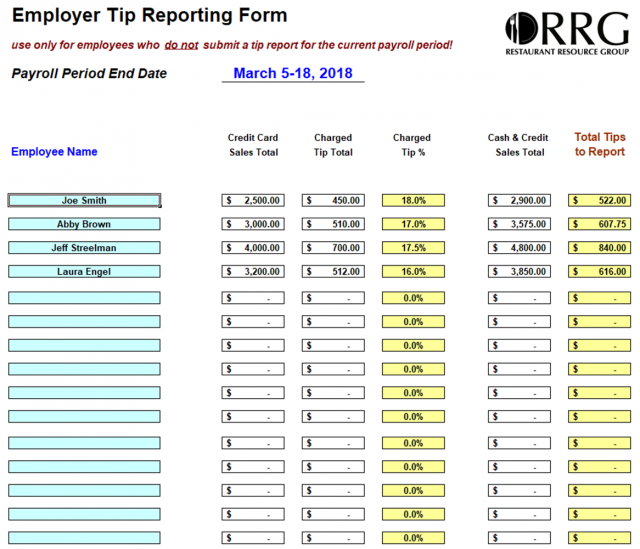

Restaurant Resource Group What Employers Need to Know About Tip Reporting

Employers use form 8027 to: Report all tips on an individual income tax return. Provide it in any format, but put it in writing: You can use form 4070a, employee's daily record of tips,. Otherwise, here is the information required;

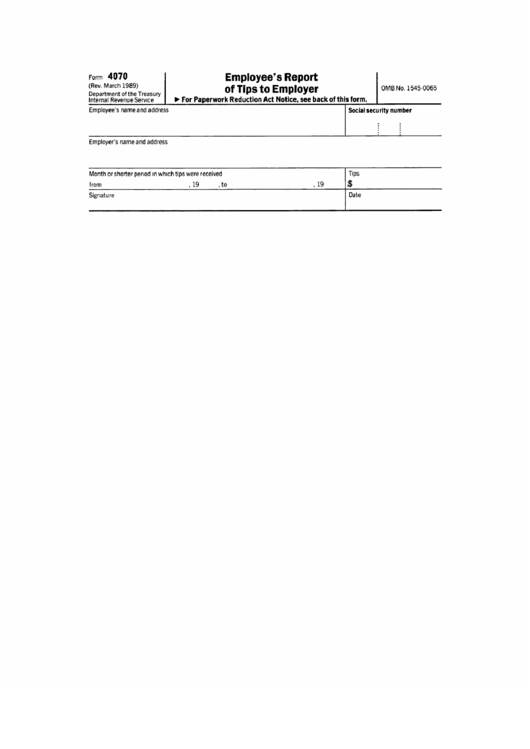

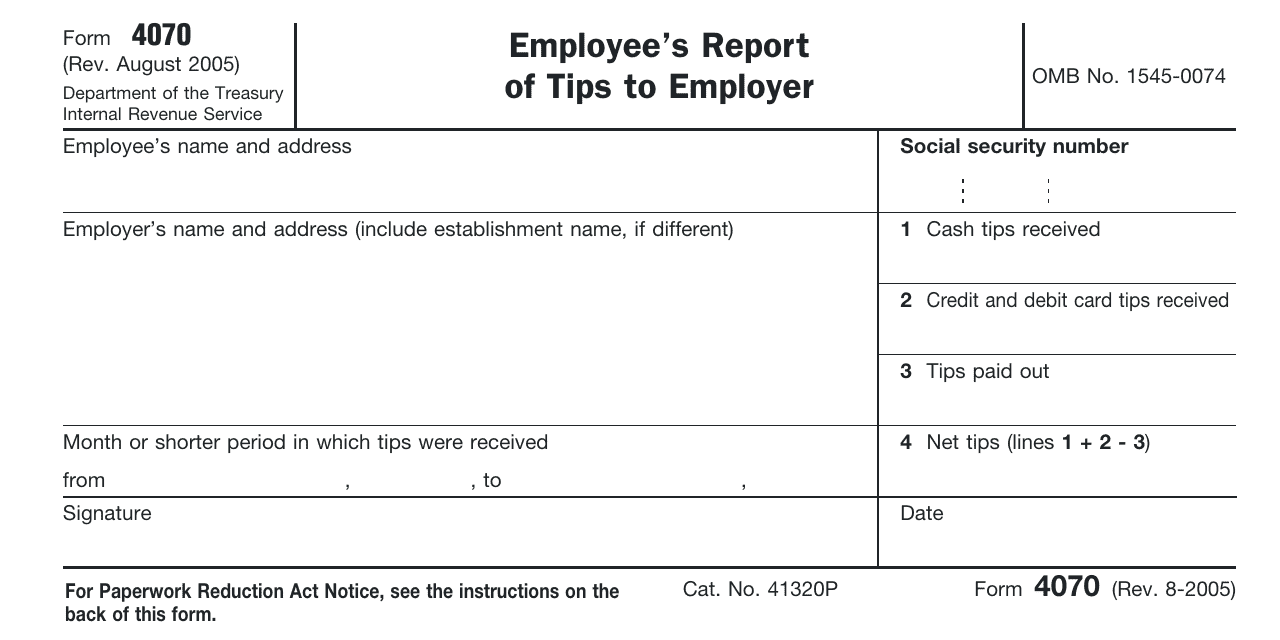

Tip Reporting Form Gratuity Irs Tax Forms

Employees must keep a daily record of tips received. Report all tips on an individual income tax return. Determine allocated tips for tipped employees. Use this form to track and report your employee's tips. Keep a daily tip record.

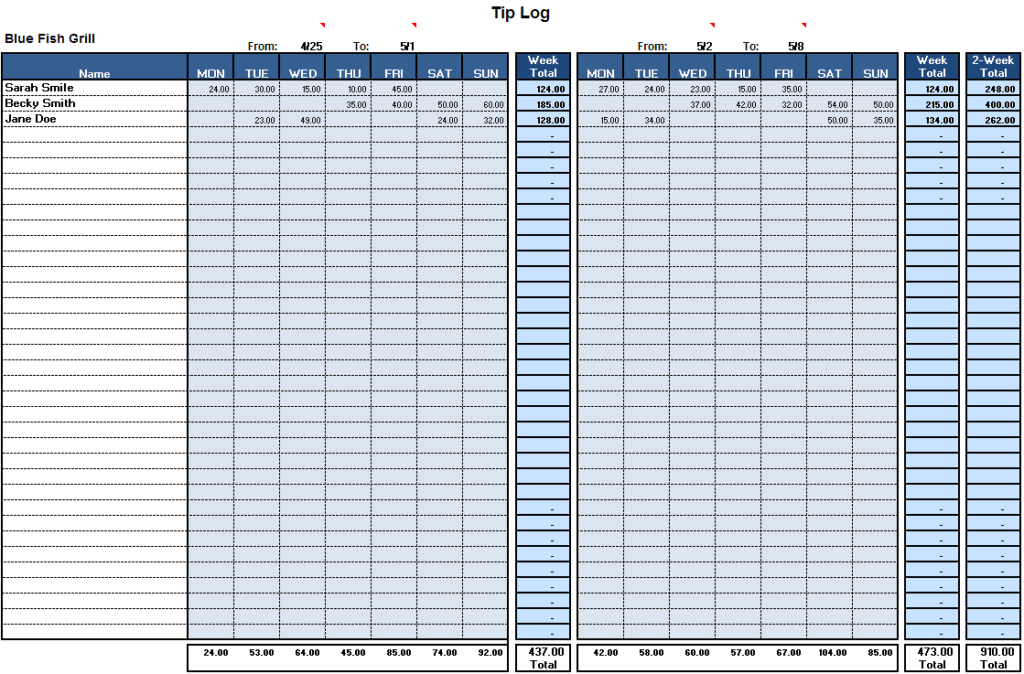

Tip Tracker Spreadsheet —

Employers use form 8027 to: Otherwise, here is the information required; Use this form to track and report your employee's tips. Keep a daily tip record. Generally, you must report all tips you received in the tax year on your tax return.

Printable Tip Reporting Sheet Printable Word Searches

Annually report to the irs receipts and tips from their large food or beverage establishments. Employees must keep a daily record of tips received. Keep a daily tip record. Determine allocated tips for tipped employees. You may use irs form 4070 to report tips to your employer.

Printable Tip Reporting Sheet

Use this form to track and report your employee's tips. Generally, you must report all tips you received in the tax year on your tax return. Provide it in any format, but put it in writing: You may use irs form 4070 to report tips to your employer. Otherwise, here is the information required;

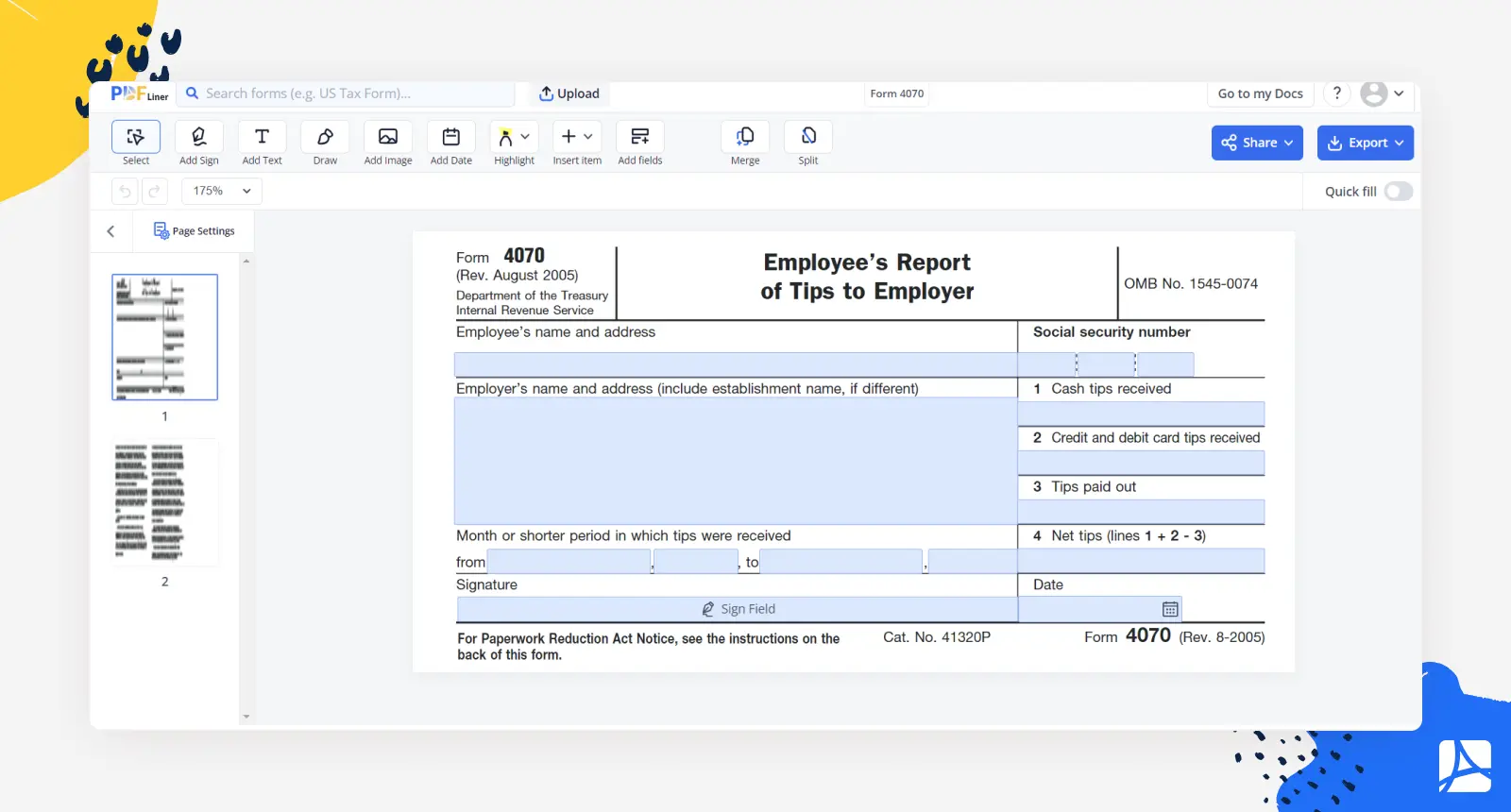

Irs Form 4070 Fillable Printable Forms Free Online

Use this form to track and report your employee's tips. Annually report to the irs receipts and tips from their large food or beverage establishments. Provide it in any format, but put it in writing: Determine allocated tips for tipped employees. Employees must keep a daily record of tips received.

Irs Form 4070a Printable Printable Forms Free Online

Determine allocated tips for tipped employees. Provide it in any format, but put it in writing: Annually report to the irs receipts and tips from their large food or beverage establishments. Keep a daily tip record. Report all tips on an individual income tax return.

Irs tip reporting form 4070 Fill online, Printable, Fillable Blank

Otherwise, here is the information required; You can use form 4070a, employee's daily record of tips,. Determine allocated tips for tipped employees. Generally, you must report all tips you received in the tax year on your tax return. Report all tips on an individual income tax return.

Employee Tip Reporting Form Printable Form 2024

This includes both server cash tips as well as credit card tips recorded by your pos system for each server. Keep a daily tip record. Otherwise, here is the information required; Employers use form 8027 to: Generally, you must report all tips you received in the tax year on your tax return.

Annually Report To The Irs Receipts And Tips From Their Large Food Or Beverage Establishments.

You may use irs form 4070 to report tips to your employer. Otherwise, here is the information required; Generally, you must report all tips you received in the tax year on your tax return. Provide it in any format, but put it in writing:

This Includes Both Server Cash Tips As Well As Credit Card Tips Recorded By Your Pos System For Each Server.

Use this form to track and report your employee's tips. Employees must keep a daily record of tips received. You can use form 4070a, employee's daily record of tips,. Report all tips on an individual income tax return.

Keep A Daily Tip Record.

Employers use form 8027 to: Determine allocated tips for tipped employees.