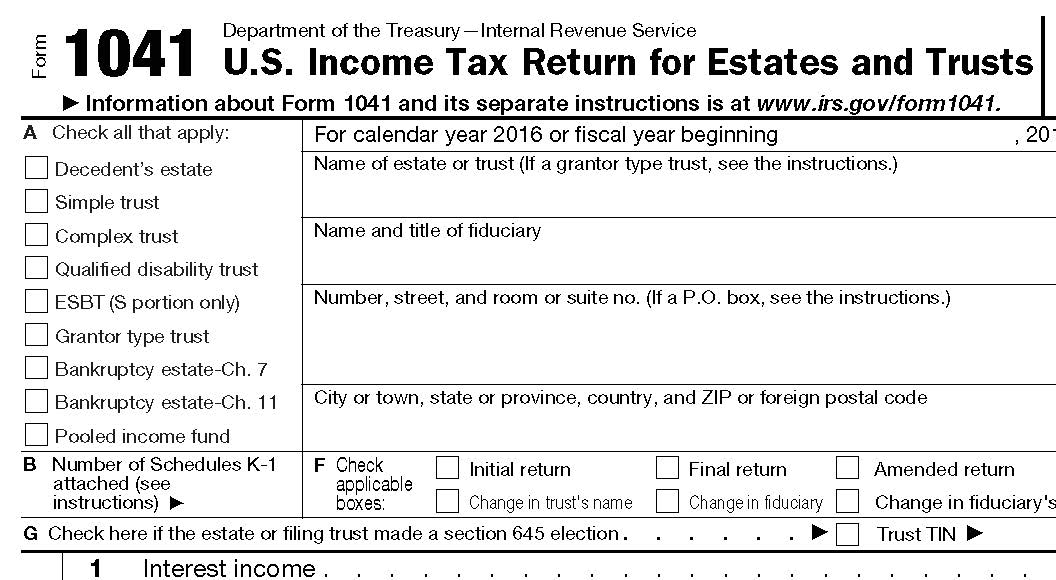

Trust Administration Expenses Deductible On Form 1041 - What expenses might qualify for the deduction? Section 212, which allows deductions for amounts paid or. If the qrt files a form 1041 for this short period, and a valid section 645 election is subsequently made, then the trustee must file an amended. Most expenses of administering an estate or trust are deductible by reason of i.r.c. Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be.

Section 212, which allows deductions for amounts paid or. Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. Most expenses of administering an estate or trust are deductible by reason of i.r.c. If the qrt files a form 1041 for this short period, and a valid section 645 election is subsequently made, then the trustee must file an amended. What expenses might qualify for the deduction?

What expenses might qualify for the deduction? Most expenses of administering an estate or trust are deductible by reason of i.r.c. Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. Section 212, which allows deductions for amounts paid or. If the qrt files a form 1041 for this short period, and a valid section 645 election is subsequently made, then the trustee must file an amended.

4 things to know to complete trust returns Trust, Things to know

Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. Section 212, which allows deductions for amounts paid or. What expenses might qualify for the deduction? If the qrt files a form 1041 for this short period, and a valid section 645 election is subsequently made, then the trustee must.

How Long Does it Take to Settle a Trust in California? Geiger Law Office

If the qrt files a form 1041 for this short period, and a valid section 645 election is subsequently made, then the trustee must file an amended. What expenses might qualify for the deduction? Section 212, which allows deductions for amounts paid or. Most expenses of administering an estate or trust are deductible by reason of i.r.c. Property taxes would.

Estate Tax Return When is it due?

Most expenses of administering an estate or trust are deductible by reason of i.r.c. Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. Section 212, which allows deductions for amounts paid or. What expenses might qualify for the deduction? If the qrt files a form 1041 for this short.

to this Week’s Online Class with The American College ppt

Section 212, which allows deductions for amounts paid or. Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. Most expenses of administering an estate or trust are deductible by reason of i.r.c. What expenses might qualify for the deduction? If the qrt files a form 1041 for this short.

2024 Form 1041 Tedi Abagael

Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. Most expenses of administering an estate or trust are deductible by reason of i.r.c. Section 212, which allows deductions for amounts paid or. If the qrt files a form 1041 for this short period, and a valid section 645 election.

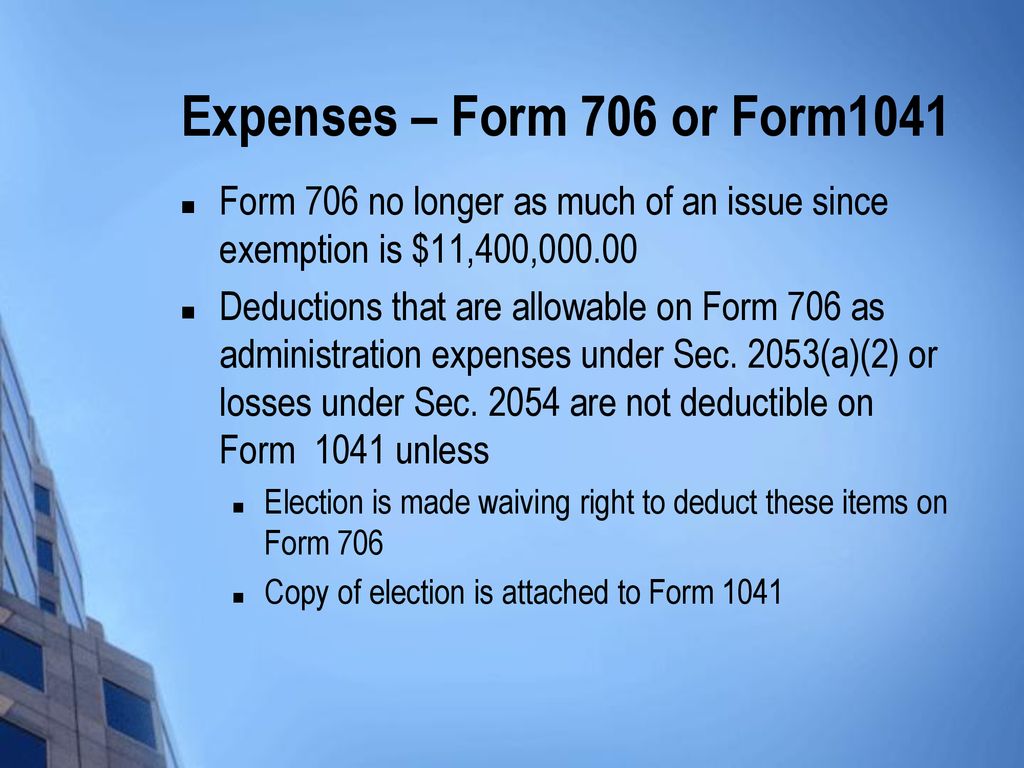

Final Form 1040 & 1041 Trusts More Than Meets the Eye ppt download

Section 212, which allows deductions for amounts paid or. Most expenses of administering an estate or trust are deductible by reason of i.r.c. What expenses might qualify for the deduction? If the qrt files a form 1041 for this short period, and a valid section 645 election is subsequently made, then the trustee must file an amended. Property taxes would.

What expenses are deductible on a 1041?

What expenses might qualify for the deduction? Most expenses of administering an estate or trust are deductible by reason of i.r.c. If the qrt files a form 1041 for this short period, and a valid section 645 election is subsequently made, then the trustee must file an amended. Section 212, which allows deductions for amounts paid or. Property taxes would.

Are Legal Expenses For Estate Planning Deductible Jeremy Eveland

Most expenses of administering an estate or trust are deductible by reason of i.r.c. Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. What expenses might qualify for the deduction? Section 212, which allows deductions for amounts paid or. If the qrt files a form 1041 for this short.

Final Form 1040 & 1041 Trusts More Than Meets the Eye ppt download

Most expenses of administering an estate or trust are deductible by reason of i.r.c. Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. What expenses might qualify for the deduction? If the qrt files a form 1041 for this short period, and a valid section 645 election is subsequently.

Final Form 1040 & 1041 Trusts More Than Meets the Eye ppt download

What expenses might qualify for the deduction? Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. Section 212, which allows deductions for amounts paid or. Most expenses of administering an estate or trust are deductible by reason of i.r.c. If the qrt files a form 1041 for this short.

If The Qrt Files A Form 1041 For This Short Period, And A Valid Section 645 Election Is Subsequently Made, Then The Trustee Must File An Amended.

Property taxes would be deductible on line 11 of form 1041 (taxes in turbotax business) while mortgage interest would be. Section 212, which allows deductions for amounts paid or. What expenses might qualify for the deduction? Most expenses of administering an estate or trust are deductible by reason of i.r.c.

.jpg)

.jpg)