Vehicle Use Form - Dep arr (11) travel time (12) odometer reading dep. Information about form 2290, heavy. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable. Official business other authorized use (9) authorized by (10) time. Use form 2290 to report and pay 2290 dues on any highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or.

Use form 2290 to report and pay 2290 dues on any highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or. Official business other authorized use (9) authorized by (10) time. Dep arr (11) travel time (12) odometer reading dep. Information about form 2290, heavy. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Information about form 2290, heavy. Dep arr (11) travel time (12) odometer reading dep. Official business other authorized use (9) authorized by (10) time. Use form 2290 to report and pay 2290 dues on any highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or.

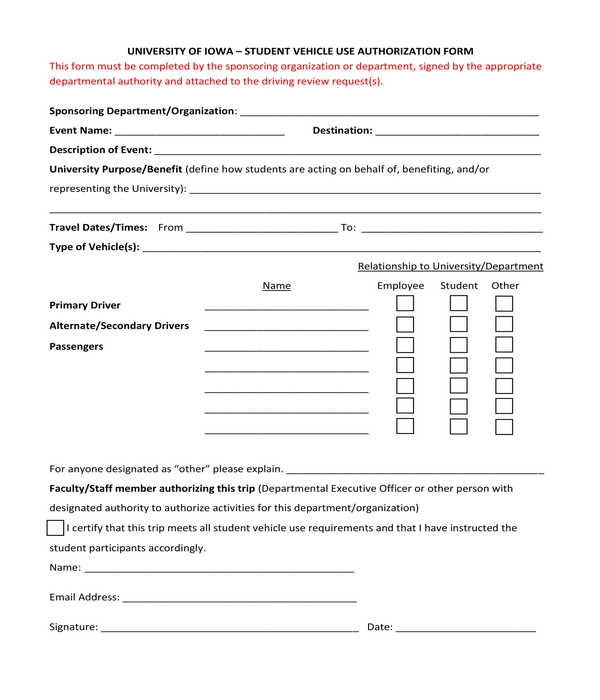

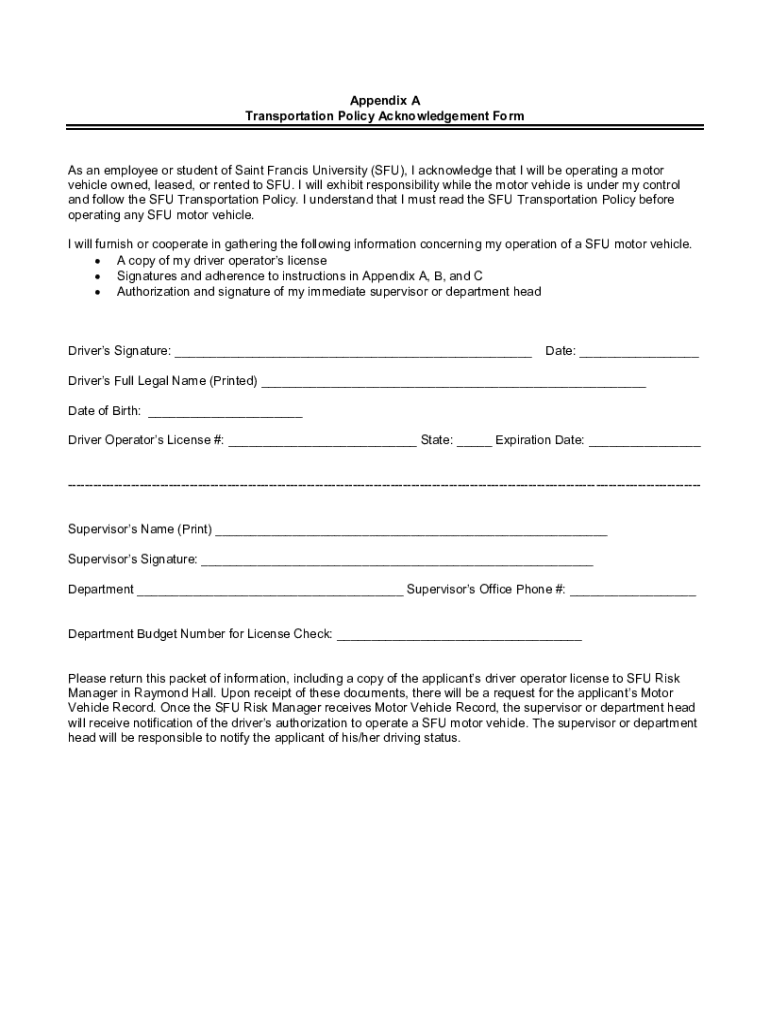

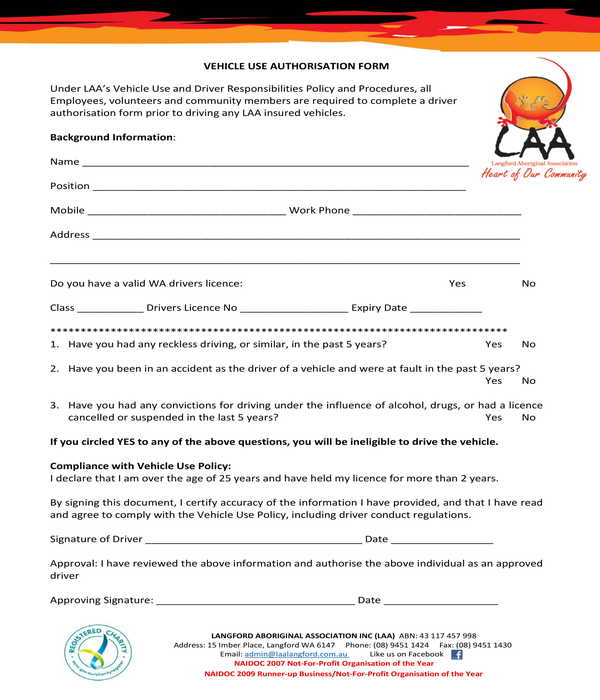

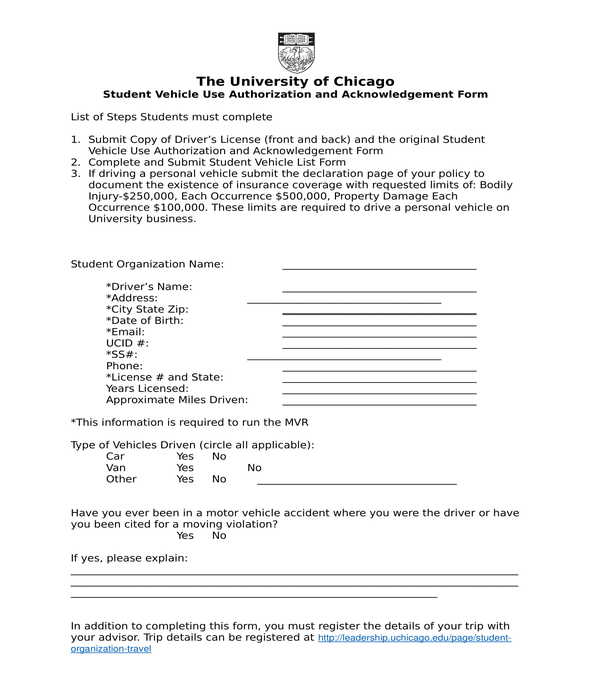

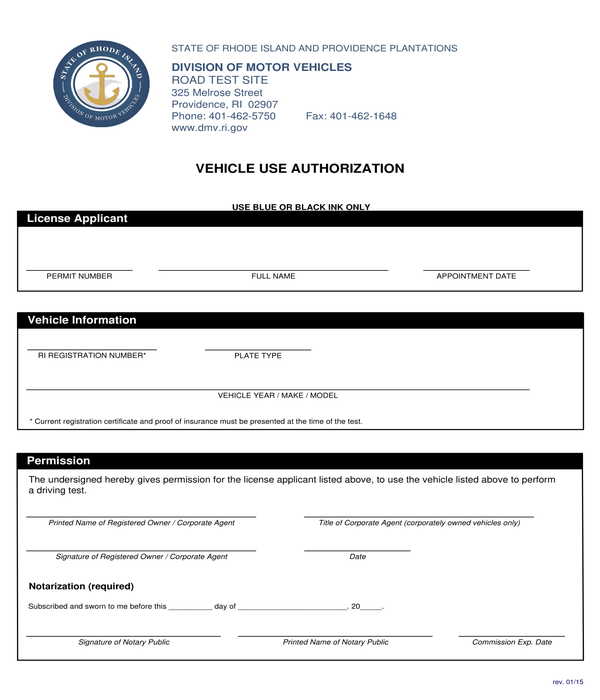

FREE 6+ Vehicle Use Authorization Forms in PDF MS Word

Use form 2290 to report and pay 2290 dues on any highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or. Information about form 2290, heavy. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. You must file form 2290 and schedule 1 for the tax.

Fillable Online VehicleUseForm.pdf Fax Email Print pdfFiller

Official business other authorized use (9) authorized by (10) time. Dep arr (11) travel time (12) odometer reading dep. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if.

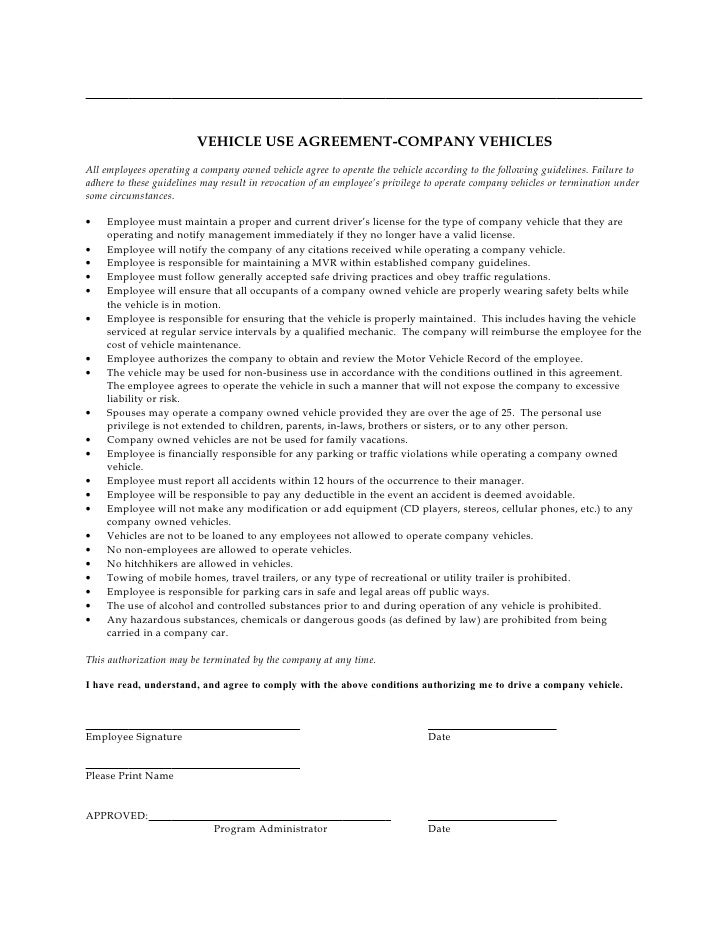

Company Vehicle Use Agreement

Official business other authorized use (9) authorized by (10) time. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable. Information about form 2290, heavy. Use form.

Vehicle Use Request Form

Use form 2290 to report and pay 2290 dues on any highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or. Information about form 2290, heavy. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable. Dep arr.

Vehicle Use Registration Form Excel Template And Google Sheets File For

Use form 2290 to report and pay 2290 dues on any highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or. Official business other authorized use (9) authorized by (10) time. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025,.

FREE 6+ Vehicle Use Authorization Forms in PDF MS Word

Information about form 2290, heavy. Use form 2290 to report and pay 2290 dues on any highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable. Dep arr.

Company Vehicle Checklist Templates at

Dep arr (11) travel time (12) odometer reading dep. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Official business other authorized use (9) authorized by.

FREE 6+ Vehicle Use Authorization Forms in PDF MS Word

Dep arr (11) travel time (12) odometer reading dep. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Official business other authorized use (9) authorized by (10) time. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if.

FREE 6+ Vehicle Use Authorization Forms in PDF MS Word

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Dep arr (11) travel time (12) odometer reading dep. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable. Information about form 2290, heavy. Use form 2290.

Free Company Vehicle Use Management Form Excel Template Form Templates

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Dep arr (11) travel time (12) odometer reading dep. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable. Use form 2290 to report and pay 2290.

Information About Form 2290, Heavy.

Dep arr (11) travel time (12) odometer reading dep. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Use form 2290 to report and pay 2290 dues on any highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or. You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2024, and ending on june 30, 2025, if a taxable.