What Is A 8300 Form - The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction.

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form.

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file.

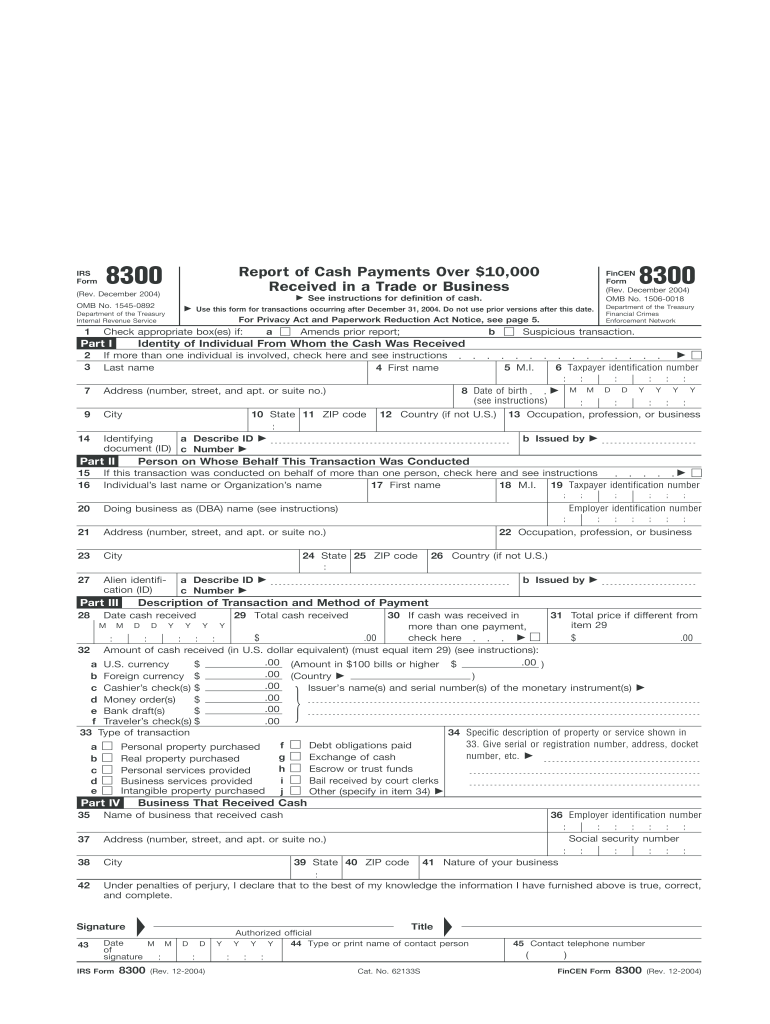

2004 Form IRS 8300 Fill Online, Printable, Fillable, Blank PDFfiller

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Each person engaged in a trade or business who, in the course of that.

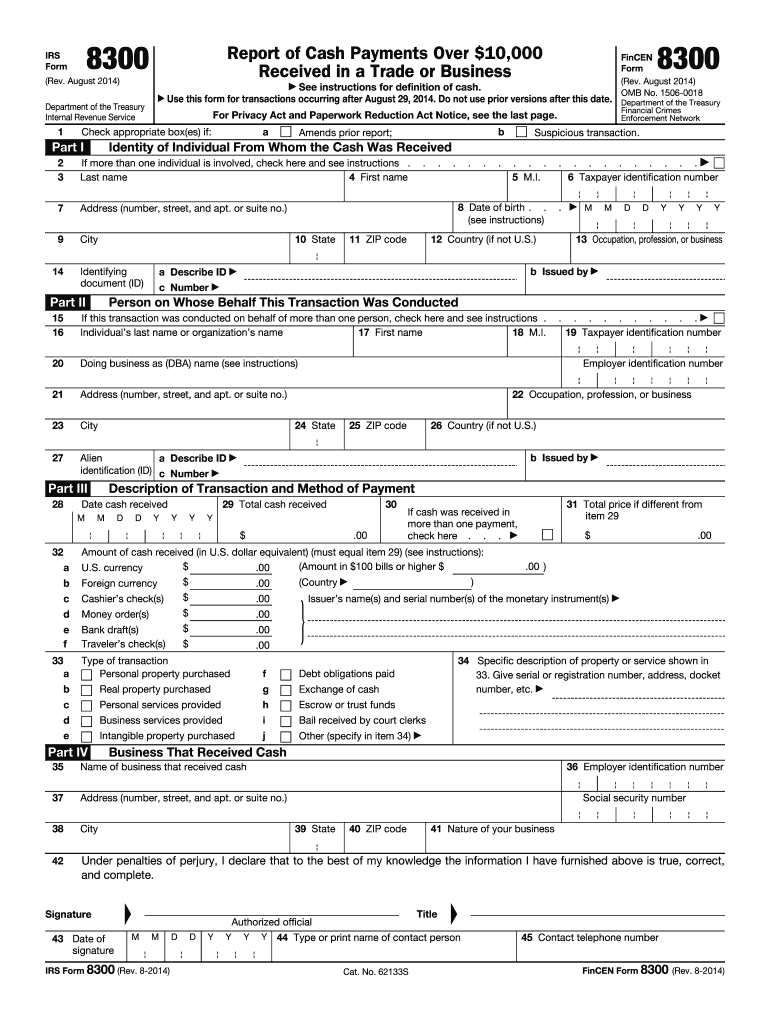

2014 Form IRS 8300 Fill Online, Printable, Fillable, Blank pdfFiller

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that.

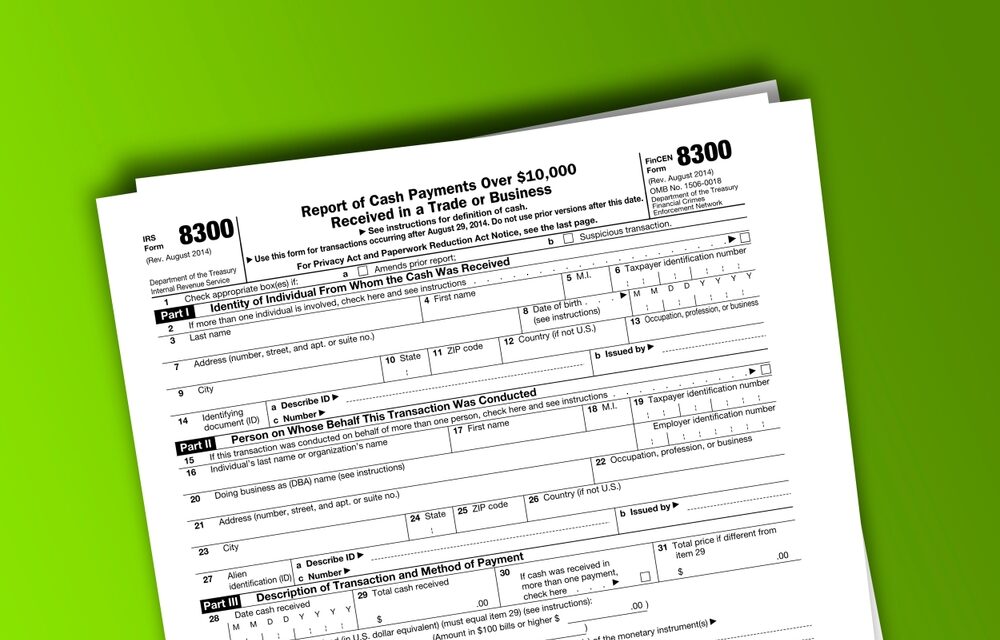

What Is Form 8300 and How Do You File It? Hourly, Inc.

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Each person engaged in a trade or business who, in the course of that trade or business, receives.

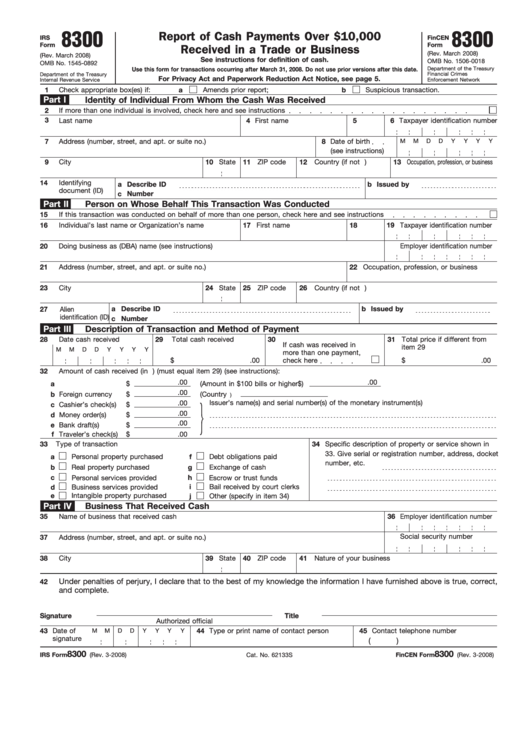

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. The law requires trades and businesses report cash payments of more than $10,000 to.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Generally, any person in a trade or business who receives more than $10,000 in cash in.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Usd Received

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that.

IRS Form 8300 Reporting Cash Sales Over 10,000

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Each person engaged in a trade or business who, in the course of that.

Form 8300 Scuba Exchange Art

The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that.

Form 8300 Reporting Cash Payments over 10,000 HM&M

The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Generally, any person in a trade or business who receives more than $10,000 in cash in.

8300 Irs Form 2023 Printable Forms Free Online

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Form 8300 is a document that businesses use to report cash payments received in excess of.

Each Person Engaged In A Trade Or Business Who, In The Course Of That Trade Or Business, Receives More Than $10,000 In Cash.

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction.